If you’re wondering how to choose motorcycle insurance provider in the U.S.

this guide will walk you through everything — from comparing quotes to understanding coverage types, spotting hidden costs, and picking the right plan for your riding style.

it’s about protection, reliability, and peace of mind every time you ride.

With dozens of insurers offering different coverage types, discounts, and support levels,That’s why it’s essential to understand how to choose motorcycle insurance provider that aligns with your specific riding lifestyle and budget.

And let’s not forget — in most U.S. states, having at least liability coverage isn’t optional; it’s the law.

In this 2025 guide, we’ll walk you through exactly how to choose the best motorcycle insurance provider — by comparing coverage options, reading real rider reviews, spotting hidden costs, and making smart decisions that suit your bike and lifestyle.

How to Choose Motorcycle Insurance Provider in the U.S. (2025 Checklist)

Choosing the right motorcycle insurance provider in the U.S. requires more than just comparing prices.

It’s about finding a company that offers solid protection, responsive customer service, and flexibility tailored to your riding needs.

Here are the key factors every U.S. rider should evaluate before picking a provider:

Coverage Options Offered

Not all policies are created equal. Make sure the provider offers core coverages such as:

-

Liability (mandatory in most states)

-

Collision

-

Comprehensive

-

Medical Payments

-

Uninsured/Underinsured Motorist Coverage

Also, look for providers that offer add-on options like:

-

Trip interruption coverage

-

Custom parts/accessory protection

-

Total loss replacement

💡 Pro Tip: Before selecting coverage, ask yourself how you ride — daily or occasionally. This self-check is key when learning how to choose motorcycle insurance provider that matches your real-world risks.

Customer Service and Claim Process

When accidents happen, a smooth claims experience makes all the difference. Look for companies that offer:

-

24/7 claims service

-

Mobile app functionality

-

Clear claim filing process

Don’t forget to read real rider reviews on TrustPilot, BBB, and J.D. Power for insight into how the insurer treats its customers.

Understanding how to choose motorcycle insurance provider also means knowing which companies are responsive when it truly matters — during the claim process.

🔎 Real-World Tip: If a provider takes days to respond to a quote, imagine how they’ll handle a claim. Responsiveness should always factor into how to choose motorcycle insurance provider that won’t leave you stranded.

Financial Strength and Industry Reputation

You need an insurer that will still be around when you need them.

Check their ratings from:

-

AM Best

-

Moody’s

-

Standard & Poor’s

Also, look for providers with a long-standing presence in the U.S. market and minimal claim disputes.

Keep this in mind as you evaluate how to choose motorcycle insurance provider that won’t fail you when you file a claim.

Pricing and Available Discounts

Cheap premiums often come with trade-offs. Instead, aim for value — a balance between affordability and reliable coverage.

Ask about discounts for:

-

Safe riding record

-

Bundling with home/auto policies

-

Military or veteran status

-

Taking an approved safety course

-

Membership in motorcycle associations (like AMA)

Savings vary, but some riders save up to 25% with the right discount combo.

Policy Flexibility and Add-Ons

A one-size-fits-all policy rarely works for motorcycle owners. Opt for insurers that allow:

-

Policy customization

-

Flexible deductibles

-

Add-ons like:

-

Roadside assistance

-

Rental reimbursement

-

OEM parts guarantee

-

This flexibility is crucial when you’re figuring out how to choose motorcycle insurance provider that matches your individual protection needs.

What the Top U.S. Motorcycle Insurance Providers Offer (Real Examples)

With so many motorcycle insurance providers in the U.S., narrowing down your options can be tough — especially when every company claims to offer the “best deal.”

To help guide your decision, here are five top-rated insurance companies U.S. riders commonly trust.

These aren’t recommendations — they’re examples to show what you should look for when evaluating quotes and coverage.

Progressive

One of the most popular choices among U.S. riders, Progressive offers comprehensive motorcycle insurance with highly customizable plans.

Why riders like it:

-

Flexible coverage: Add-ons include total loss coverage, accessory protection, and roadside assistance

-

Multiple discount opportunities: Safe driver, multi-policy, responsible rider

-

Competitive pricing even for newer riders

Best For: Riders looking for flexible, full-featured coverage

GEICO

GEICO is known for affordable motorcycle insurance and a fast, user-friendly experience — especially online.

Why it stands out:

-

Customizable policy options for casual and daily riders

-

Discounts for military, government employees, and safety course completion

-

Great customer service scores across most U.S. states

Best For: Budget-conscious riders who value ease and speed

State Farm

If you prefer a more personal approach, State Farm delivers with its nationwide network of local agents and strong financial reputation.

Why riders choose State Farm:

-

Reliable claims process and responsive local support

-

Strong standard coverage: liability, collision, comprehensive

-

Option to bundle with home/auto policies for savings

Best For: Riders who want a real agent they can talk to

Allstate

Allstate offers coverage tailored to motorcycle enthusiasts — including riders of cruisers, sport bikes, and even custom builds.

What makes it valuable:

-

Accident forgiveness, replacement cost coverage, and optional equipment protection

-

Multiple policy customization options

-

Nationwide claim support and local agents

Best For: Riders with higher-value or custom motorcycles

Nationwide

Nationwide is ideal for those who want long-term savings and custom coverage flexibility.

Why it’s a good choice:

-

Unique features like vanishing deductibles and accident forgiveness

-

Strong bundle discounts for home, renters, or life insurance

-

Easy online quote and claims portal

Best For: Riders who want rewards for safe driving and loyalty

Key Takeaway:

While each provider has its strengths, the best one for you depends on your riding style, bike value, location, and budget. Use these examples as a reference when comparing policy features, not as a one-size-fits-all solution.

How to Compare Motorcycle Insurance Quotes in the U.S. (Step-by-Step Guide)

Comparing motorcycle insurance quotes isn’t just about finding the lowest premium — it’s about discovering the right balance of cost, coverage, and service for your specific riding needs.

One of the best ways to learn how to choose motorcycle insurance provider is by comparing real-time quotes using trusted U.S. tools.

Here’s a simple step-by-step process to help you evaluate quotes like a pro:

This part of the guide is essential for anyone learning how to choose motorcycle insurance provider based on policy clarity and cost structure.

1. Understand the Policy Details

Don’t just glance at the price. Dive into the quote and read:

-

Coverage limits (liability, collision, etc.)

-

Deductibles for each coverage type

-

Exclusions (e.g., off-road use, track racing, aftermarket parts)

-

Terms & conditions that may affect your ability to claim

⚠️ Always ask: “What’s NOT covered?” — that’s where surprises usually hide.

2. Balance Premium vs. Deductible

-

lower premium often means a higher deductible (more out-of-pocket if you crash).

-

A higher premium may offer better protection, especially for newer or expensive bikes.

Goal: Find a policy that balances monthly affordability with reasonable risk coverage.

3. Look for Hidden Fees or Coverage Gaps

Some quotes may leave out essentials like:

-

Uninsured motorist protection

-

Accessory coverage

-

Roadside assistance

Always verify whether these are included or cost extra.

4. Use Trusted Online Comparison Tools

Use U.S.-based tools to instantly compare quotes side by side:

These tools allow you to:

-

Filter by coverage type

-

See discounts applied

-

Read user reviews

-

Customize quotes in real time

💬 Smart Tip: Don’t just compare total cost — line up coverage types, deductibles, and exclusions. This step is non-negotiable if you’re serious about how to choose motorcycle insurance provider the right way.

5. Ask About Discounts and Bundling

Ask providers about:

-

Multi-policy (home + auto + bike)

-

Safe rider history

-

Military or veteran status

-

Motorcycle club membership (like AMA)

-

Completion of a certified safety course

These can save you 10%–30% or more annually.

By comparing motorcycle insurance quotes with a focus on coverage depth, policy clarity, and added value, you can confidently choose the plan that fits both your budget and biking lifestyle.

A good quote isn’t always the cheapest — it’s the one that protects you best when it matters most.

The next step in learning how to choose motorcycle insurance provider is knowing which mistakes to avoid when reviewing options.

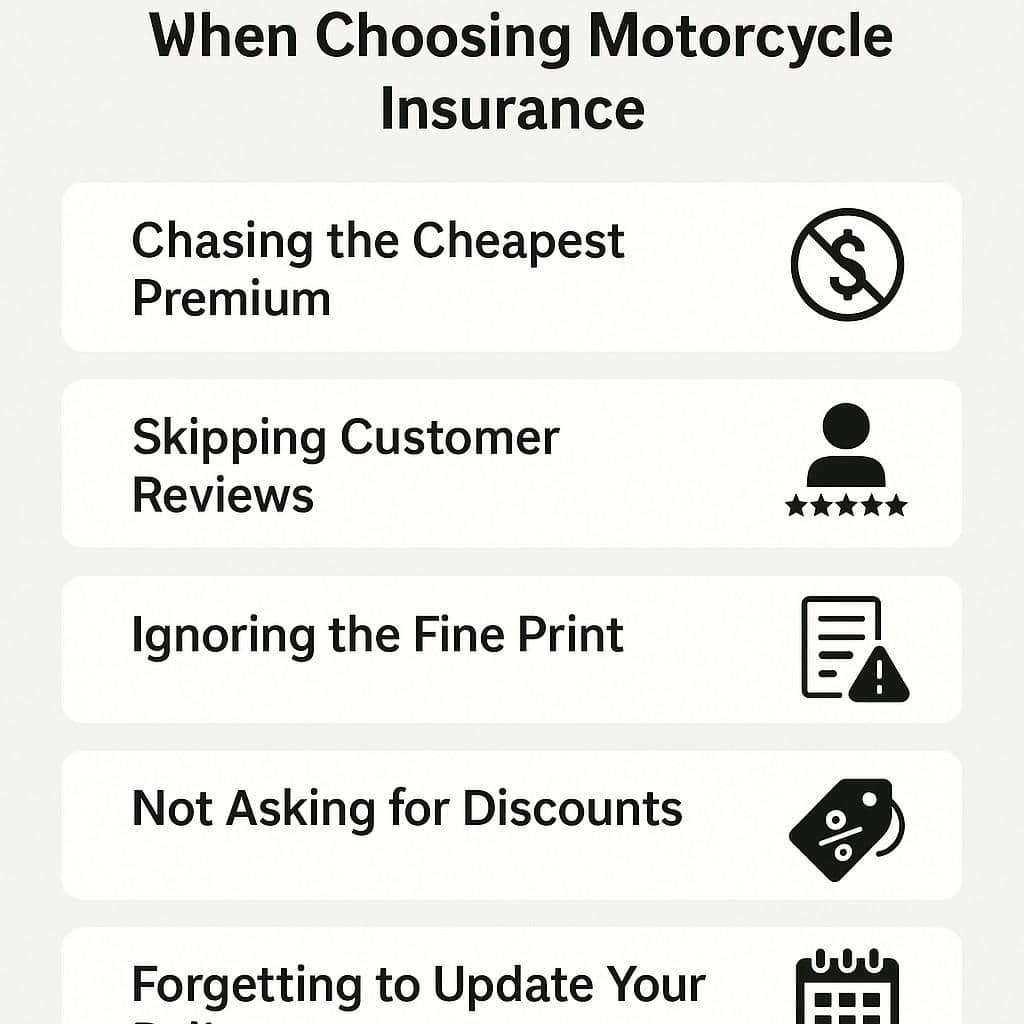

Avoid These 5 Costly Mistakes When Choosing Motorcycle Insurance

Not understanding how to choose motorcycle insurance provider can lead to costly errors like buying based only on price.

Choosing motorcycle insurance for the first time? Or just trying to switch providers?

If you’re a new rider and still figuring out your coverage basics, check out our motorcycle insurance guide for first-time riders to start with confidence.

Even experienced riders make these common mistakes — and they can lead to denied claims, hidden costs, or worse: being underinsured when you need protection the most.

Here’s what to avoid when picking your policy:

1. Chasing the Cheapest Premium

💬 “It’s just $10 a month — done!”

Hold up! That low rate might not cover much at all.

Why it hurts you:

Cheapest often means:

-

High deductibles

-

Minimal liability coverage

-

No theft or damage protection

Instead: Look for the best value, not just the lowest price. Match your quote to what you actually need.

2. Skipping Customer Reviews

💬 “They’re a big name — must be fine.”

Not always. Even well-known companies can have terrible claims service.

What to check:

-

TrustPilot & BBB reviews

-

Claim satisfaction ratings

-

How easy it is to reach support

Pro Tip: Search “[company name] motorcycle insurance reviews” on Google before buying.

3. Ignoring the Fine Print

💬 “I thought towing was included?”

Surprise exclusions are a rider’s nightmare.

Commonly missed exclusions:

-

Aftermarket parts

-

Non-factory paint jobs

-

Off-road accidents

-

Coverage outside your state

Action: Ask your insurer for a coverage summary sheet and read the exclusions section line by line.

4. Not Asking for Discounts

💬 “They didn’t mention any deals.”

That’s because you have to ask — many discounts aren’t automatically applied.

Hidden savings you might qualify for:

-

Clean riding record

-

Military or veteran status

-

Motorcycle safety course

-

Multi-policy bundles (home/auto + bike)

Pro Tip: Ask the agent directly: “What discounts am I missing out on?”

5. Forgetting to Update Your Policy

💬 “I’ve had the same coverage since 2018.”

If your bike changed or you moved states — your old policy might no longer fit.

When to update:

-

You upgraded your motorcycle

-

You moved to a new ZIP code

-

You changed your riding frequency (daily vs. seasonal)

Tip: Do a policy check-up every 12 months, even if nothing seems wrong.

Mistakes with motorcycle insurance can be expensive, stressful, and totally avoidable.

Take your time. Ask questions. And use these warning signs as a checklist to make sure you’re getting the protection — and peace of mind — you deserve on every ride.

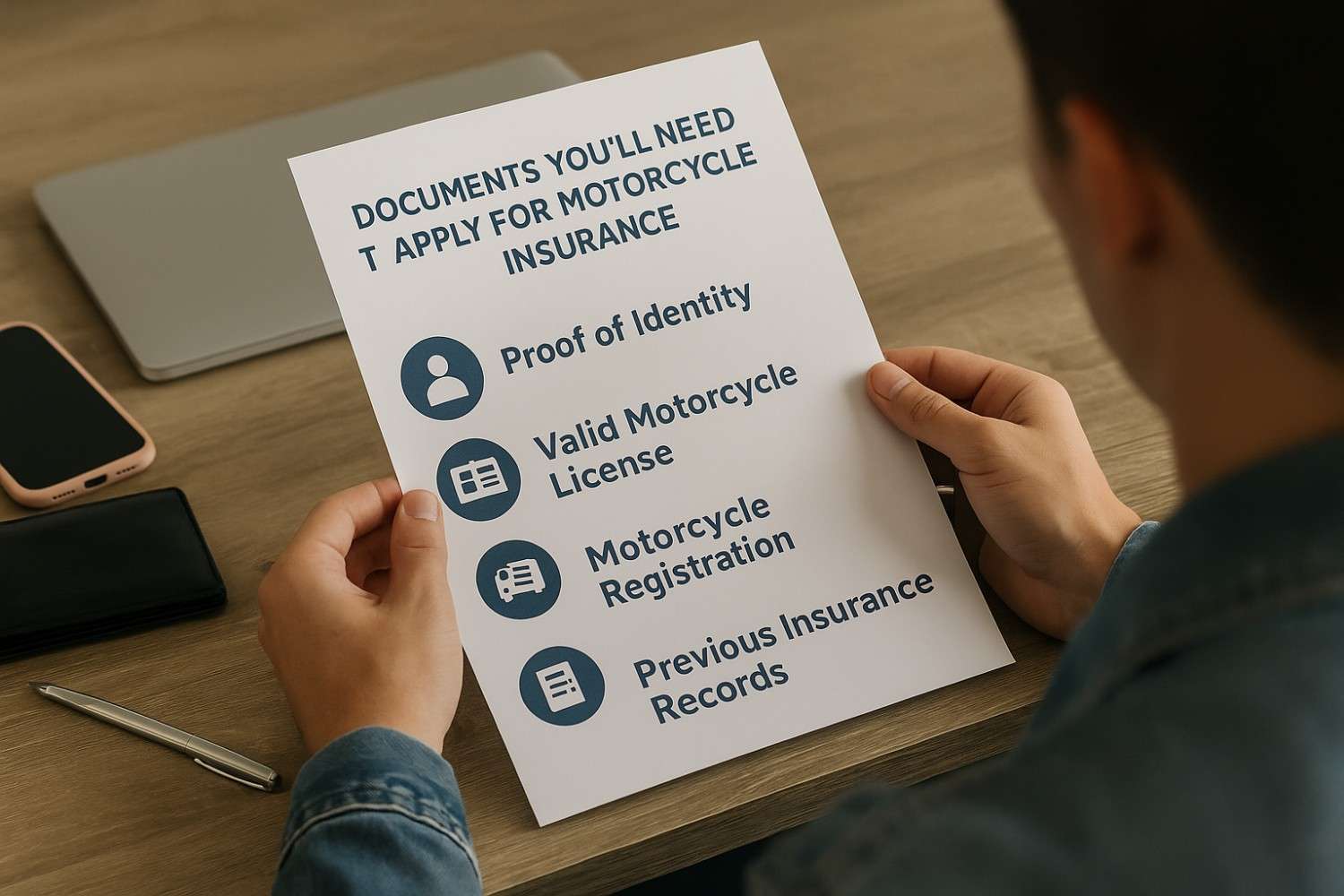

Checklist: Documents You’ll Need to Apply for Motorcycle Insurance (U.S. Riders)

Applying for motorcycle insurance in the U.S.? Having your documents ready can save you time and help you lock in better rates.

Here’s a simple checklist of what most insurers will ask for — whether you’re buying online or through an agent:

Having these ready is a smart move if you’re serious about how to choose motorcycle insurance provider efficiently and avoid application delays.

1. Proof of Identity

📎 What to Provide:

-

Government-issued photo ID (Driver’s License, State ID, or Passport)

🧾 Why It Matters:

It verifies you’re eligible for coverage under U.S. insurance laws and helps confirm your identity.

2. Valid Motorcycle License

📎 What to Provide:

-

A motorcycle-endorsed driver’s license (Class M or equivalent in your state)

🧾 Why It Matters:

Most insurers won’t issue coverage without a valid motorcycle license. Riding without one may increase your premium or lead to denial.

💡 Tip: If you’re still in training, check for temporary coverage options available in some states.

3. Motorcycle Registration

📎 What to Provide:

-

Your bike’s official registration papers

🧾 Why It Matters:

It proves ownership and includes important details like make, model, VIN, and year — all of which impact your quote.

4. Previous Insurance Records (If Any)

📎 What to Provide:

-

Past motorcycle policy number(s), insurer details, and duration

🧾 Why It Matters:

A clean claims history or continuous coverage can unlock loyalty or safe rider discounts.

💡 If you had a lapse in coverage, be honest — some providers still offer affordable high-risk policies like Dairyland.

5. Payment Method

📎 What to Provide:

-

Credit/debit card

-

ACH bank info (for auto-pay)

-

Online wallet (if supported)

🧾 Why It Matters:

Most policies go live only after payment — some insurers even offer small discounts for setting up auto-pay.

Final Reminder:

Organizing these documents ahead of time ensures:

-

A smoother quote and sign-up process

-

Faster policy activation

-

Better chances of accessing hidden savings

These steps are a must for anyone learning how to choose motorcycle insurance provider and complete the process smoothly.

Conclusion

By following this guide, you’ll understand how to choose motorcycle insurance provider that protects your wallet and your ride.

Choosing the right motorcycle insurance provider isn’t just a paperwork decision — it’s a key part of staying protected on the road, both financially and legally.

By focusing on what matters most — coverage options, customer support, discounts, and flexibility — you can confidently pick a provider that fits your bike, your lifestyle, and your budget.

If you rush the process, you risk missing key factors in how to choose motorcycle insurance provider that truly fits your needs.

Take time to compare quotes, read real reviews, and ask the right questions.

Now that you’ve seen how to choose motorcycle insurance provider from every angle — coverage, quotes, discounts, and mistakes — you’re ready to make a smart, confident choice.

The effort you put in now could save you thousands later — and give you peace of mind every time you hit the throttle.

💡 Remember: The best motorcycle insurance is the one that covers you before you even know you need it.